ICRA has re-affirmed the long-term rating of Dynamatic Technologies (DTL) to BB+ for the Rs 1.91 billion (revised from Rs 1.84 billion) term loan facilities and the Rs 940 million (revised from Rs 860 million) long-term fund based facilities.

ICRA has also re-affirmed the short-term rating of A4+ to the Rs 715 million (revised from Rs725 million) short-term non-fund based facilities of DTL. The outlook on the long term rating is revised from stable to positive.

The revision in the rating outlook factors in the expected improvement in the DTL's liquidity profile post completion of sale of major non-core assets identified by the company; the capital infusion through planned qualified institutional placement and conversion of the entire promoter subscribed warrants into equity shares. ICRA expects the aforementioned measures to generate adequate cash proceeds in relation to DTL's near to medium term obligations thereby supporting the company in de-leveraging its balance sheet in the absence of any major debt funded capex. This is also expected to aid in significantly easing the pressure on its cash accruals and in turn improving its credit metrics over the medium term. However, the Company's ability to execute its capital raising plans in a timely manner and significantly reduce its debt obligations will remain a key rating sensitivity in the near term.

The revision in the rating outlook factors in the expected improvement in the DTL's liquidity profile post completion of sale of major non-core assets identified by the company; the capital infusion through planned qualified institutional placement and conversion of the entire promoter subscribed warrants into equity shares. ICRA expects the aforementioned measures to generate adequate cash proceeds in relation to DTL's near to medium term obligations thereby supporting the company in de-leveraging its balance sheet in the absence of any major debt funded capex. This is also expected to aid in significantly easing the pressure on its cash accruals and in turn improving its credit metrics over the medium term. However, the Company's ability to execute its capital raising plans in a timely manner and significantly reduce its debt obligations will remain a key rating sensitivity in the near term.

The ratings continue to take into account established track record of DTL with a reputed client base across business divisions, its single source supplier status with major global customers and healthy order position across business verticals providing business visibility. Strong order book position under its aerospace division - being a highly value accretive business is likely to support the company's overall business growth and aid in enhancing the overall profitability and the business mix of the Company over medium to long-term. However, healthy growth momentum witnessed under its aerospace division during 2013-14 was offset to an extent by continued weak operating performance of automotive segment.

This was mainly attributable to the weak demand scenario in the domestic automotive market resulting in sub-optimal utilization of the installed capacities, in turn restricting DTL's ability to improve the operating accruals. However, the resolution of power supply related issues (through direct power supply from the grid for its automotive and foundry plants) and increased captive sourcing remains a credit positive and is likely to aid in margin expansion over the medium term with expected ramp up in utilizations. Further, although the automotive division continued to remain a drag during 2013-14, DTL's strong technological capabilities, measures towards product/ customer rationalization and international presence (through acquisition of EEG) are expected to aid in reviving the performance of the automotive division going forward. The company's financial profile remains relatively strained marked by stretched capital structure and modest coverage indicators. The company's ability to improve its operating performance across business divisions and ease the pressure on its capital structure and debt protection metrics would remain the key rating sensitivities going forward.

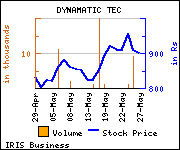

Shares of the company gained Rs 45, or 5%, to trade at Rs 945.00. The total volume of shares traded was 794 at the BSE (12.12 p.m., Wednesday).